Robust unit root tests are developed for dynamic panels consisting of TAR processes. The test statistics are all based on diverse combinations of individual t-type tests for significance of TAR coefficients. Limiting null distributions are established...

http://chineseinput.net/에서 pinyin(병음)방식으로 중국어를 변환할 수 있습니다.

변환된 중국어를 복사하여 사용하시면 됩니다.

- 中文 을 입력하시려면 zhongwen을 입력하시고 space를누르시면됩니다.

- 北京 을 입력하시려면 beijing을 입력하시고 space를 누르시면 됩니다.

부가정보

다국어 초록 (Multilingual Abstract)

Robust unit root tests are developed for dynamic panels consisting of TAR processes. The test statistics are all based on diverse combinations of individual t-type tests for significance of TAR coefficients. Limiting null distributions are established. A Monte-Carlo experiment compares the proposed tests. The tests are applied to a panel data set of Canadian unemployment rates which show asymmetric features as well as having outliers.

참고문헌 (Reference)

1 IMSL, "User's Manual" IMSL 1989

2 Levin, A, "Unit root tests in panel data: Asymptotic and finite-sample properties" 108 : 1-24, 2002

3 Choi, I, "Unit root tests for panel data" 20 : 249-272, 2001

4 Shin, D. W, "Unit root tests for panel MTAR model with cross-sectionally dependent error" SPRINGER HEIDELBERG 67 (67): 315-326, 2008

5 Shin, D. W, "Unit root tests based on adaptive maximum likelihood estimation" 15 : 1-23, 1999

6 Lucas, A, "Unit root tests based on M estimators" 11 : 331-346, 1995

7 Enders, W, "Unit root tests and asymmetric adjustment with an example using the term structure of interest rates" 16 : 304-311, 1998

8 Caner, M, "Threshold autoregression with a near unit root" 69 : 1555-1596, 2001

9 Shin, D. W, "Tests for asymmetry in possibly nonstationary time series data" 19 : 233-244, 2001

10 Im, K. S, "Testing for unit roots in heterogeneous panels" 115 : 53-74, 2003

1 IMSL, "User's Manual" IMSL 1989

2 Levin, A, "Unit root tests in panel data: Asymptotic and finite-sample properties" 108 : 1-24, 2002

3 Choi, I, "Unit root tests for panel data" 20 : 249-272, 2001

4 Shin, D. W, "Unit root tests for panel MTAR model with cross-sectionally dependent error" SPRINGER HEIDELBERG 67 (67): 315-326, 2008

5 Shin, D. W, "Unit root tests based on adaptive maximum likelihood estimation" 15 : 1-23, 1999

6 Lucas, A, "Unit root tests based on M estimators" 11 : 331-346, 1995

7 Enders, W, "Unit root tests and asymmetric adjustment with an example using the term structure of interest rates" 16 : 304-311, 1998

8 Caner, M, "Threshold autoregression with a near unit root" 69 : 1555-1596, 2001

9 Shin, D. W, "Tests for asymmetry in possibly nonstationary time series data" 19 : 233-244, 2001

10 Im, K. S, "Testing for unit roots in heterogeneous panels" 115 : 53-74, 2003

11 서병선, "Testing for two-regime threshold cointegration in vector error-correction models" 110 : 293-318, 200209

12 Moon, H. R, "Testing for a unit root in panels with dynamic factors" Elsevier BV 122 (122): 81-126, 2004

13 Choi, I, "Subsampling hypothesis tests for nonstationary panels with applications to exchange rates and stock prices" 22 : 233-264, 2007

14 Huber, P. J, "Robust Statistics" John Wiley & Sons 1981

15 Shin, D. W, "Recursive mean adjustment for unit root tests" 22 : 595-612, 2001

16 Gengenbach, C., "Panel Unit Root Tests in the Presence of Cross- sectional Dependencies: Comparison and Implications for Modelling" Econometric Reviews 2010

17 Herwartz, H, "Homogenous panel unit root tests under cross sectional dependence: Finite sample modifications and the wild bootstrap" 53 : 137-150, 2008

18 Phillips, P. C. B, "Dynamic panel estimation and homogeneity testing under cross section dependence" 6 : 217-259, 2003

19 Koop, G, "Dynamic asymmetries in U.S. unemployment" 17 : 298-312, 1999

20 Herce, M. A, "Asymptotic theory of LAD estimation in a unit root process with finite variance errors" 12 : 129-153, 1996

21 Tsay, R. S, "Analysis of Financial Time Series, 2nd edition" John Wiley & Sons 2005

22 So, B. S, "An invariant sign test for random walks based on recursive median adjustment" 102 : 197-229, 2001

23 Shin, D. W, "An instrumental variable approach for panel unit root tests under cross-sectional dependence" ELSEVIER SCIENCE SA 134 : 215-234, 2006

24 Pesaran, M. H, "A simple panel unit root test in the presence of cross-section dependence" 22 : 265-312, 2007

25 Shin, D. W, "A robust sign test for panel unit roots under cross sectional dependence" Elsevier 53 : 1312-1327, 2009

26 Bai, J, "A PANIC attack on unit roots and cointegration" 72 : 1127-1177, 2004

동일학술지(권/호) 다른 논문

-

- 한국통계학회

- 박진아

- 2011

- KCI등재,ESCI

-

- 한국통계학회

- 오만숙

- 2011

- KCI등재,ESCI

-

Hyper-Parameter in Hidden Markov Random Field

- 한국통계학회

- 임요한

- 2011

- KCI등재,ESCI

-

- 한국통계학회

- 정승환

- 2011

- KCI등재,ESCI

분석정보

인용정보 인용지수 설명보기

학술지 이력

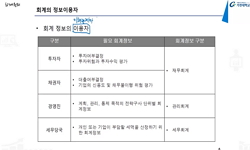

| 연월일 | 이력구분 | 이력상세 | 등재구분 |

|---|---|---|---|

| 2027 | 평가예정 | 재인증평가 신청대상 (재인증) | |

| 2021-01-01 | 평가 | 등재학술지 유지 (재인증) |  |

| 2018-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2015-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2011-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2009-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2007-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2005-01-01 | 평가 | 등재학술지 유지 (등재유지) |  |

| 2002-07-01 | 평가 | 등재학술지 선정 (등재후보2차) |  |

| 2000-01-01 | 평가 | 등재후보학술지 선정 (신규평가) |  |

학술지 인용정보

| 기준연도 | WOS-KCI 통합IF(2년) | KCIF(2년) | KCIF(3년) |

|---|---|---|---|

| 2016 | 0.38 | 0.38 | 0.38 |

| KCIF(4년) | KCIF(5년) | 중심성지수(3년) | 즉시성지수 |

| 0.35 | 0.34 | 0.565 | 0.17 |

ScienceON

ScienceON DBpia

DBpia